Battery electric commercial vehicles (BEVs) are crucial for protecting the climate. Unlike diesel vehicles, BEVs emit no local carbon dioxide and, virtue of their high energy efficiency, make a significant contribution to reducing greenhouse gas emissions even where green electricity is not yet available. However, batteries are expensive, which in turn drives up the purchase price. Given that the transport industry is already struggling with high costs, this represents a significant financial hurdle for many companies.

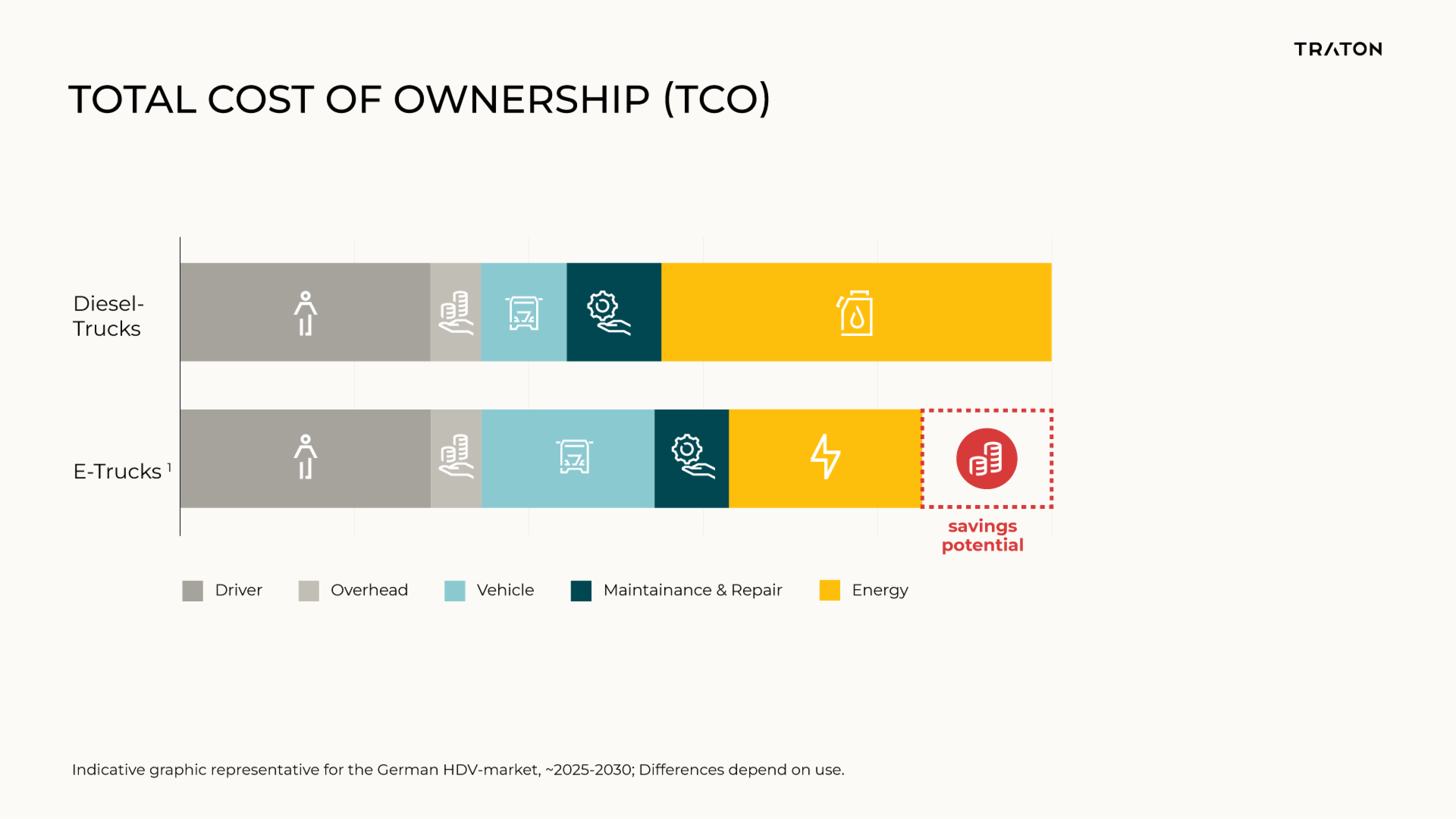

Is e-mobility only an option for transport companies who are economically stable and can make investments easily? “This may be true early on for conventional models of buying the truck outright,” counters Andreas Kammel, Vice President Alternative Drivetrains in the TRATON GROUP. “But when going by the total cost of ownership (TCO), which includes running costs, operators of battery-electric truck or bus fleets will eventually pay less, not more. The decisive factor for economic efficiency is that commercial vehicles are often intensively used capital goods for which fuel costs significantly exceed the purchase price over their entire service life.”

“In freight transport, the TCO is generally dominated by operational expenses: energy cost, driver cost, and – to a lesser extent – maintenance costs. Crucially, electricity is cheaper than diesel even when accounting for the cost of charging, which results in a growing cost advantage over time, especially so in intensively used applications such as haulage.” explains Kammel.

Battery-electric drivetrains offer significant potential for energy cost savings

So, what is ultimately motivating customers to transition to an electric fleet? Primarily economic concerns, in addition to operational sustainability goals and technological progress in battery range and energy density, analyses Stefan Sahlmann, Vice President EV Solutions & Activation at Navistar and previously Vice President, Head of MAN Transport Solutions at MAN Truck & Bus. “Our customers recognize there is a significant cost-saving potential with this new technology. For example, a customer from the US state of Tennessee recently told me that he is saving more than 50% of his monthly energy costs just by operating the new fully electric school bus from IC Bus compared to the previous school bus equipped with an internal combustion engine.”

Innovative financial services provide a basis for partnership-driven transformation

The importance of needs-based financial services has surged, particularly in meeting evolving customer demands within the transport industry. As the TRATON GROUP’s integrated and global captive financial services provider, TRATON Financial Services aims to make sustainable transport a reality through in-depth industry knowledge and integrated solutions.

This includes the development of new business models such as ‘Truck-as-a-Service’, aimed at a customer-centered and subscription-based service model. It integrates offerings for insurance, maintenance, energy and charging infrastructure into a unified source. TRATON Financial Services is currently working on bespoke solutions that will be offered by the TRATON GROUP’s brands to fleet operators.

Under the leadership of Johan Haeggman, who previously served as CFO of Scania from April 2015 to March 2022, TRATON Financial Services is dedicated to meeting the growing demand for new technologies and business models. Haeggman brings extensive experience in captive financing from his tenure at Scania. Alongside Scania Financial Services, MAN Financial Services, and Volkswagen Financial Services, TRATON Financial Services has established a strong presence in the financing market. With the addition of Navistar Financial, captive financing is now available in the North American market, while plans are underway to introduce it in South America via Volkswagen Truck & Bus. By 2025, TRATON Financial Services aims to expand its operations to twelve markets across six continents.

The captive financing being established by TRATON Financial Services is primarily focused on maximizing customer satisfaction. Unlike conventional banks or financing service providers, TRATON possesses an in-depth understanding of the business models and challenges specific to transport companies. This enables TRATON to tailor its solutions directly to the needs of this sector.

Options for financing the acquisition of battery electric commercial vehicles

TRATON and its four brands, Scania, MAN Truck & Bus, Navistar, and Volkswagen Truck & Bus, offer a range of financing solutions tailored to meet the specific financial needs of customers, particularly considering the substantial initial investments required in both infrastructure and vehicles. The fundamental principle guiding these solutions is that no investment in sustainable and economically viable drive technologies for the freight transport should be hindered by a lack of startup capital.

“There are basically two ways to finance a truck. Either you buy it, or you rent it,” says Fredrik Allard, Senior Vice President and Head of E-Mobility at Scania. “The option for customers to rent or lease their vehicle has taken center stage at TRATON. It is now an integral part of the total truck solution,” he adds.

This concept is currently undergoing a successful trial at JUNA, a joint venture between Scania and the Berlin logistics startup sennder. It is looking for solutions to the afore-mentioned problem that high acquisition costs for an electric truck – two-to-three times higher than for a combustion engine – make customers reluctant to switch to battery electric commercial vehicles despite the cost advantages down the line.

JUNA has developed an innovative pay-per-use model designed to address this challenge. Under this model, customers pay a fixed price per kilometer for the usage of an electric vehicle provided by the joint venture. This fee not only covers the use of the vehicle but also includes all expenses for repairs, maintenance, insurance, and digital and analytical services. Moreover, JUNA offers customized route suggestions upon request, optimizing the efficiency of customer operations. Such comprehensive solutions not only bolster customer confidence but also foster long-term relationships by providing a sense of security. “This approach enhances customer loyalty by encouraging them to purchase more vehicles from our brands,” says Allard.

Once an electric truck is acquired and put into operation, assessing its residual value becomes crucial. TRATON supports its customers in determining the residual value of the battery after several years of usage. Currently, the Company’s brands are exploring methods for reusing or recycling truck batteries at the end of their life cycle. The objective is not only to recycle valuable raw materials for cost efficiency, but also to promote a circular economy and prolong the life cycle of individual battery components.

Further information regarding the technological aspects of BEVs and batteries can be found here.

Financial packages available for fleet owners

The transition to e-mobility is economically supported by government subsidies and financing options provided by manufacturers. To ensure that customers navigate the complex landscape of subsidies effectively, the brands offer assistance in identifying applicable state subsidies. They provide guidance on assembling the most advantageous overall package and leveraging all available funding opportunities.

-

Government support incentivizes companies to invest in initiatives aimed at reducing, mitigating, and eliminating greenhouse gas emissions. This encompasses investments in power generation, charging infrastructure and vehicle procurement. However, in Germany, funding from the climate protection initiative for businesses was halted in December 2023 due to significant deficits in the federal budget.

-

In Germany, purchasers of e-trucks or e-buses benefit from exemptions from the CO2-dependent truck tolls. Electric vehicles may also qualify for exemptions from certain taxes, such as motor vehicle tax or other levies associated with vehicle operation.

-

Loans facilitate the acquisition of commercial vehicles equipped with battery-electric drives and the expansion of on-site charging infrastructure at depots. Specialized loans with reduced interest rates may be available for electric vehicle purchases. As a fully-integrated, Group-wide global financial services provider, TRATON Financial Services offers an extensive range of financing solutions to support its customers. Through these initiatives, TRATON Financial Services is emerging as a vital partner to the transport industry, aiding in the transition towards a CO2-neutral future.