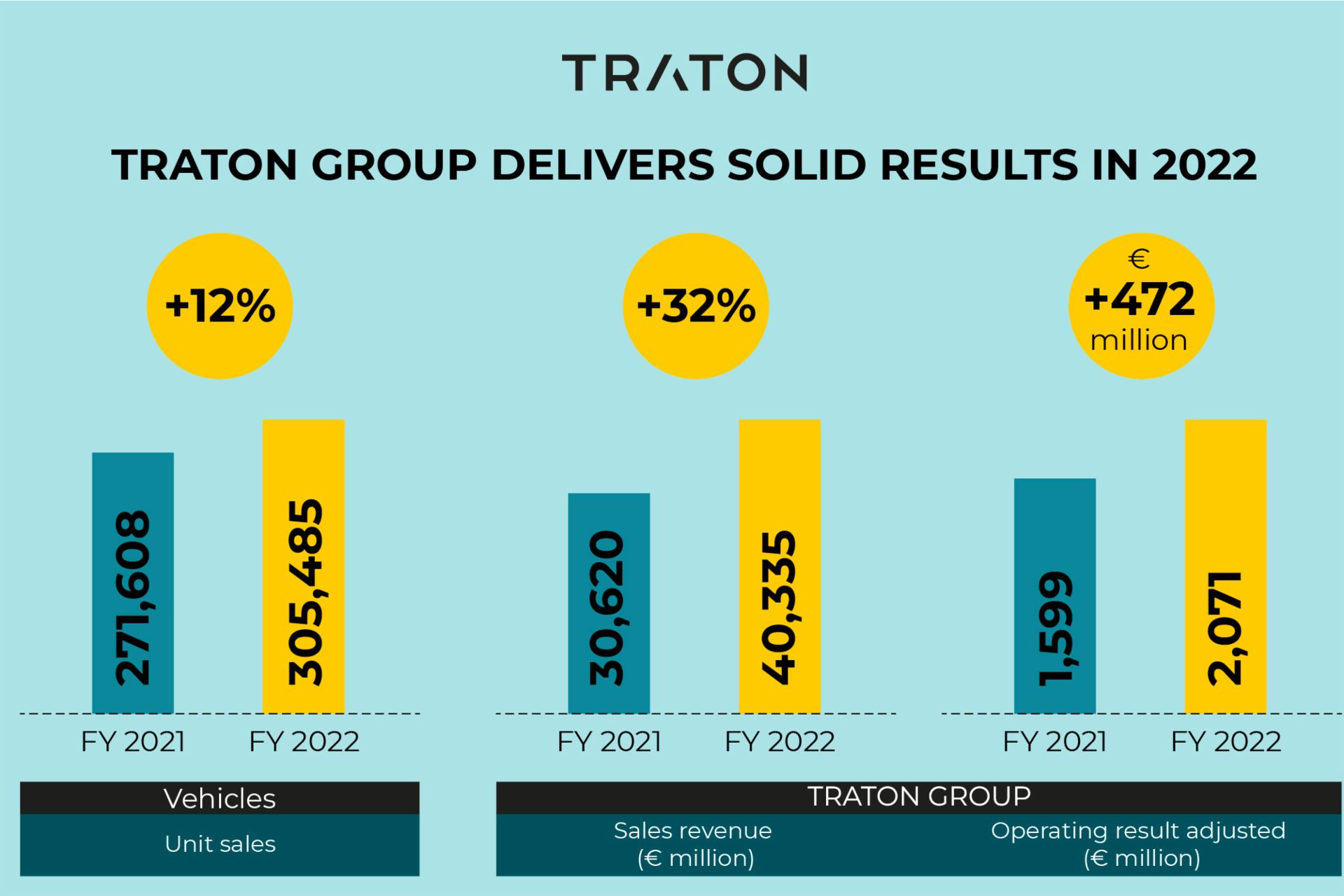

Munich, 7. März 2023 – The TRATON GROUP delivered a good performance in 2022 in an exceptionally challenging environment and lifted its sales revenue by almost a third year-on-year from €30.6 billion to over €40 billion for the first time. The increase in sales revenue was attributable to higher unit sales of new vehicles as a result of the Navistar integration, a positive market and product mix, good price realization, and strong growth in the Vehicle Services business. Excluding Navistar, sales revenue would have been up 10% year-on-year. Accounting for 21% of total sales revenue, the Vehicle Services business contributed considerably to business performance with €8.5 billion (2021: €6.4 billion).

The Group’s adjusted operating result grew €472 million to €2.1 billion (2021: €1.6 billion) despite the substantial effects of supply bottlenecks as well as the production stop at MAN Truck & Bus in connection with the war in Ukraine and the associated lower capacity utilization. At 5.1%, adjusted operating return on sales remained on a level with the previous year (5.2%) and thus within the forecast range of 5.0 to 6.0%.

Christian Levin, CEO of the TRATON GROUP: “I’ve worked in the commercial vehicle industry for almost 30 years, and I cannot recall a single year as full of challenges as 2022 — from the COVID-19 pandemic and massive supply chain disruptions to the war in Ukraine, the energy crisis in Europe, and with inflation at some of the highest levels seen in history. In spite of all these challenges and in a true feat of strength, our excellent team managed to deliver a remarkable result and make progress in executing our strategy. I am really grateful that Navistar’s customers are so interested in the new 13-liter Integrated Powertrain, which is based on our jointly developed Common Base Engine platform. Scania’s customers already have the opportunity to buy the new powertrain and are as enthusiastic about it as the trade press. MAN Truck & Bus will also be incorporating the new powertrain into its portfolio in the next few years, followed by Volkswagen Truck & Bus. This is a great example of how economies of scale can be achieved when our four strong brands join forces.

As well as making our collaboration more efficient, the TRATON Modular System and our new organizational setup will also make us better at giving our customers the value that they want. This will help us assume a leading role in the transition to e-mobility in the coming years, which continues to gain momentum. We were already able to sell 1,740 all-electric vehicles in 2022. That shows that we are on the right track, even though the infrastructure we so urgently need is yet to be established. 2023 will be a challenging year: supply chains and the supply of raw materials have not recovered fully, especially since uncertainty remains high as the war in Ukraine continues. As a Group, we are dedicated to delivering sustainable and efficient vehicles to our customers as quickly as possible and supporting their business with the services we offer.”

Annette Danielski, CFO of the TRATON GROUP: “In 2022, we showed how well we work together when times get tough. This is making me optimistic for the years to come. The fact that MAN Truck & Bus managed to record an adjusted operating result of €139 million despite the six- week production stop is a noteworthy achievement. Navistar has quickly become a cornerstone of our Group. With an adjusted operating return on sales of 10.5%, Volkswagen Truck & Bus achieved a double-digit margin in a challenging year. Scania became increasingly better at mastering the supply chain challenges as the year progressed, which allowed it to close 2022 successfully.

We have already done important work to set the course for TRATON Financial Services, our Group-wide integrated business unit for financial services. 2023 will be all about taking specific implementation steps: we will offer comprehensive customer financing solutions to meet the demand for new technologies. This will allow TRATON Financial Services to support the Group’s growth with new business models.

Looking ahead to 2023, we are optimistic: we expect unit sales and sales revenue in the TRATON GROUP to increase by between 5 and 15% each. An important factor in this forecast is our high order backlog, which is equivalent to a large portion of the vehicle volume we produce in an entire year. We are expecting our adjusted operating return on sales to range from 6.0 to 7.0%. Our forecast for net cash flow in the TRATON Operations business area ranges between €1.3 billion and €1.8 billion.”

This forecast is based on the expectation that there is no renewed deterioration in the supply shortages of key bought-in components and is subject to the negative impact of the war in Ukraine on industry growth and the TRATON GROUP’s business activities.

The sale of the Scania and MAN distribution companies in Russia was completed in 2022, while Scania’s financial services business was sold in the first quarter of 2023. The Group’s impairment losses and bad debt allowances totaled €477 million in 2022.

The Executive and Supervisory Boards of TRATON SE propose to the Annual General Meeting to pay out a dividend of €0.70 per share for fiscal year 2022. This would result in a payout ratio at the lower end of the target corridor of 30 to 40% of net income.

The TRATON GROUP’s most important financial key performance indicators:

|

Units |

FY 2022 |

FY 2021 |

Change |

|

TRATON GROUP |

|||

|

Incoming orders |

334,583 |

359,975 |

-7% |

|

of which trucks |

274,299 |

305,745 |

-10% |

|

of which busses |

32,274 |

22,237 |

45% |

|

of which MAN TGE vans |

28,010 |

31,993 |

-12% |

| Unit sales | 305,485 |

271,608 |

12% |

| of which trucks | 254,300 |

230,549 |

10% |

| of which busses | 29,601 |

18,857 |

57% |

| of which MAN TGE vans | 21,584 |

22,202 |

-3% |

|

TRATON GROUP |

|

|

|

| Sales revenue (€ million) | 40,335 |

30,620 |

32% |

| Operating result (€ million) | 1,564 |

393 |

1,171 |

| Operating result (adjusted) (€ million) | 2,071 |

1,599 |

472 |

| Operative return on sales (in %) | 3.9 |

1.3 |

2.6 ppt |

| Operative return on sales (adjusted) (in %) | 5.1 |

5.2 |

-0.1 ppt |

|

TRATON Operations |

|

|

|

| Sales revenue (€ million) | 39,554 |

30,103 |

31% |

| Operating result (€ million) | 1,973 |

677 |

1.296 |

|

Operating result (adjusted) (€ million) |

2,257 |

1,883 |

374 |

|

Operating return on sales (in %) |

5.0 |

2.2 |

2.8 ppt |

|

Operating return on sales (adjusted) (in %) |

5.7 |

6.3 |

-0.5 ppt |

|

Net cash flow (€ million) |

-625 |

938 |

– 1,563 |

|

TRATON Financial Services |

|

|

|

|

Sales revenue (€ million) |

1,294 |

964 |

34% |

|

Operating result (adjusted) (€ million) |

303 | 259 | 44 |

|

Operating result (€ million) |

80 |

259 |

-180 |

|

Return on equity (in %) |

4.0 |

18.6 |

- 14.6 pp |

Live stream for members of the press and analysts

A live stream to discuss the TRATON GROUP’s 2022 year-end results will take place from 10:00 CET on March 7 with the TRATON GROUP’s CEO Christian Levin and its CFO Annette Danielski. The live stream will be in English. The presentation of the year-end results will be followed by a Q&A for analysts at around 10:45 CET and then a Q&A for journalists.

You can access the conference here:

https://ir.traton.com/websites/traton/English/8900/events.html

Participants who want to ask a question during the Q&A session may pre-register and will receive dial-in details for the Q&A call: https://services.choruscall.it/DiamondPassRegistration/register?confirmationNumber=7471064&linkSecurityString=99536a338

The Media Q&A will start at around 11:40 CET and will directly follow the Analyst & Investor Q&A, which will begin after the presentation at around 10:45 CET. Please dial in at least 10 minutes before the Q&A session is scheduled to start.

A recorded version of the webcast will be available after the event.

Contact

Sacha Klingner

Head of External Communications

T +49 170 2250016

sacha.klingner@traton.com

Matthias Karpstein

Business Media Relations

T +49 172 3603071

matthias.karpstein@traton.com

TRATON SE

Hanauer Str. 641 / 80992 München / Deutschland

www.traton.com

With its brands Scania, MAN, Navistar, and Volkswagen Truck & Bus, TRATON SE is the parent and holding company of the TRATON GROUP and one of the world’s leading commercial vehicle manufacturers. The Group’s product portfolio comprises trucks, buses, and light-duty commercial vehicles. “Transforming Transportation Together. For a sustainable world.” — this intention underlines the Company’s ambition to have a lasting and sustainable impact on the commercial vehicle business and on the Group’s commercial growth.