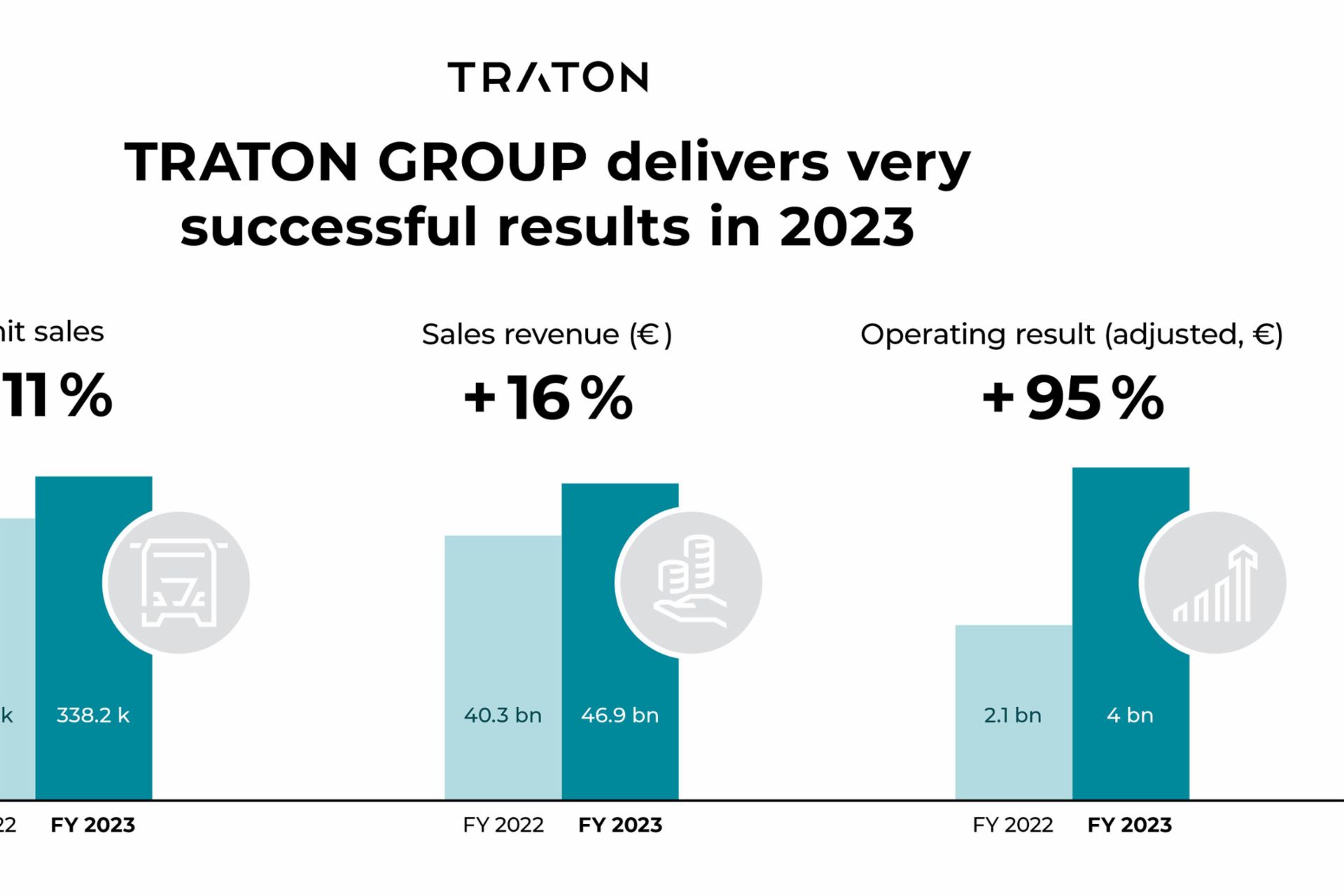

Munich, March 5, 2024 – The TRATON GROUP grew its sales revenue by 16% to €46.9 billion (2022: €40.3 billion) in 2023. The growth in sales revenue was due to higher unit sales of new vehicles in the TRATON Operations business area, a positive market and product mix, better unit price realization, and growth in the vehicle services business. Sales revenue in TRATON Financial Services grew by almost a quarter to €1.6 billion (2022: €1.3 billion) as a result of the expansion of the financing portfolio and higher interest income.

TRATON almost doubled its adjusted operating result to €4.0 billion (2022: €2.1 billion) in 2023. At 8.6% (2022: 5.1%), adjusted operating return on sales was up significantly year-on-year and also slightly above the most recently forecast range of 7.5 to 8.5%. The main drivers of the increase were higher unit sales as well as a better capacity utilization due to significantly increased production figures, especially for trucks.

Christian Levin, CEO of the TRATON GROUP: “We made 2023 a very successful year for the TRATON GROUP, thanks to the strong contribution from all our brands. For the TRATON GROUP, being successful also means driving the transition to a world of sustainable transportation. For example, the key milestones we reached in 2023 on our electric mobility journey will have a positive impact on 2024 and beyond. With the market environment for trucks generally softening in some regions, we will remain extremely focused in 2024 and capitalize on our strengths. With our established and committed brands, we focus on customer satisfaction while also working together on further efficiency gains, making us successful as a Group. This year, we will continue growing closer together to leverage our potential. Our strong order book will support us. The orders that we already have will last us into the second half of the year.”

Further progress in electric mobility

In a quest to drive forward the transformation of the transportation industry, Scania has opened a battery assembly plant at its headquarters in Södertälje. The production of chassis was revamped in 2023 to accommodate large-scale production of electric vehicles, and locating the battery assembly in its vicinity means the company has done everything to make the manufacturing process quick and efficient. Just like Scania, MAN is also getting ready to produce the all-important battery packs for electric trucks. The groundbreaking ceremony for large-scale production took place in Nuremberg in 2023. Up to 100,000 high-voltage battery packs will be produced there yearly starting in 2025, which will be used in MAN eTrucks. 700 orders and order requests have already been received. Volkswagen Truck & Bus expanded its e-Delivery offering to additional markets in Latin America and began testing its e-Volksbus in 2023.

Charging infrastructure development is urgently needed. TRATON is driving this development forward not just as part of the Milence joint venture, but also within each of the Group’s brands. Navistar, for example, has entered into a partnership with Quanta Services, a major provider of grid infrastructure solutions in North America. The launch of TRATON Charging Solutions also supports the transition to electric vehicles by simplifying access to charging stations as much as possible.

Dr. Michael Jackstein, CFO and CHRO of the TRATON GROUP: “Our brands were very successful in their markets in 2023. This led to a record sales revenue for the Group — around €47 billion. Even though we raised our forecast for adjusted operating return on sales twice during the year, we ultimately exceeded it slightly at 8.6%. Thanks to our high cash generation, we are not only able to pay out a considerable dividend to our shareholders, we also managed to significantly reduce net financial debt within TRATON Operations including Corporate Items. The market environment will be more challenging in 2024. We will tackle this by making our business more resilient to the ups and downs of the commercial vehicle markets. Our vehicle services business, which accounts for around one fifth of our sales revenue, is a great asset for this stability. At the same time, TRATON Financial Services is also growing, and 2023 saw us take an important step towards a global captive and integrated financial services business. This will allow us to offer even better solutions to our customers, and to be their partner on their journey to electrification.”

All brands contributed to success

Scania recorded sales revenue of €17.9 billion in fiscal year 2023 and thus an adjusted operating return on sales of 12.7%, 4.1 percentage points higher than in the previous year. Even though demand returned to normal in Europe, Scania still managed to increase its incoming orders by 2%. MAN Truck & Bus successfully executed its repositioning program, and the impressive figures it recorded in 2023 are testament to this success. Adjusted operating return on sales rose by 6.0 percentage points to 7.3%, and sales revenue for the year came in at €14.8 billion. Navistar recorded sales revenue of €11.0 billion and continued to improve its profitability. Itsadjusted operating return on sales was up 1.9 percentage points year-on-year at 6.6%. The company’s well filled order book gives confidence for 2024. In Brazil, the most important market for Volkswagen Truck & Bus, a new emissions standard for trucks entered into force in January 2023. This had led to pull-forward effects in 2022. Despite the resulting decline in sales revenue, Volkswagen Truck & Bus managed to record an adjusted operating return on sales of 8.8%. This was the result of its flexible partnership-based production system as well as improved product positioning and unit price realization.

Outlook for 2024 optimistic

Despite a difficult industry environment, the Executive Board is confident about 2024: the TRATON GROUP brands will continue to grow closer together to leverage more efficiency gains and successfully position their products and services on the market. Since the order bookremains well filled, developments in the TRATON GROUP’s unit sales and sales revenue are still expected to range between –5 and +10% each. A range of 8.0 to 9.0% is forecast for adjusted operating return on sales. Net cash flow in the TRATON Operations business area is forecast to range between €2.3 billion and €2.8 billion.

The Executive and Supervisory Boards of TRATON SE will propose a dividend of €1.50 (2022: €0.70) per share to the shareholders at the Annual General Meeting for fiscal year 2023. This corresponds to a total payout of €750 million (2022: €350 million).

The TRATON GROUP’s most important financial key performance indicators:

|

2023 |

2022 |

Change |

||

|

TRATON GROUP |

||||

|

Incoming orders |

264,798 |

334,583 |

–21% |

|

|

of which trucks |

210,617 |

274,299 |

–23% |

|

|

of which buses |

29,808 |

32,274 |

–8% |

|

|

of which MAN TGE vans |

24,373 |

28,010 |

–13% |

|

|

Unit sales |

338,183 |

305,485 |

11% |

|

|

of which trucks |

281,290 |

254,300 |

11% |

|

|

of which buses |

30,266 |

29,601 |

2% |

|

|

of which MAN TGE vans |

26,627 |

21,584 |

23% |

|

|

TRATON GROUP |

|

|

|

|

|

Sales revenue (€ million) |

46,872 |

40,335 |

16% |

|

|

Operating result (€ million) |

3,763 |

1,564 |

2,199 |

|

|

Operating result (adjusted) (€ million) |

4,034 |

2,071 |

1,963 |

|

|

Operating return on sales (adjusted) (in %) |

8.6 |

5.1 |

3.5 pp |

|

|

TRATON Operations |

|

|

|

|

|

Sales revenue (€ million) |

45,736 |

39,554 |

16% |

|

|

Operating result (€ million) |

4,103 |

1,973 |

2,130 |

|

|

Operating result (adjusted) (€ million) |

4,272 |

2,257 |

2,016 |

|

|

Operating return on sales (adjusted) (in %) |

9.3 |

5.7 |

3.6 pp |

|

|

Net cash flow (€ million) |

3,594 |

–625 |

4,219 |

|

|

TRATON Financial Services |

|

|

|

|

|

Sales revenue (€ million) |

1,589 |

1,294 |

23% |

|

|

Operating result (€ million) |

168 |

80 |

88 |

|

|

Operating result (adjusted) (€ million) |

269 |

303 |

–34 |

|

|

Return on equity (in %) |

8.4 |

4.0 |

4.5 pp |

|

Live stream for analysts and the press

A live stream to discuss the TRATON GROUP’s 2023 year-end results will take place from 10 a.m. CET on March 5 with the TRATON GROUP’s CEO Christian Levin and its CFO and CHRO Dr. Michael Jackstein. The live stream will be in English. The presentation of the year-end results will be followed by a Q&A for analysts at around 10:45 a.m. CET and then a second round of questions for journalists.

The event will be streamed here:

https://ir.traton.com/en/financial-dates-events/

Participants wishing to ask questions during the Q&A session can register here in advance to receive their dial-in details:

A recording of the webcast will be available after the event.

2023 Annual Report of the TRATON GROUP

Click here for the online version of the Annual Report 2023:

Contact

Sacha Klingner

Head of External Communications

T +49 170 2250016

sacha.klingner@traton.com

Matthias Karpstein

Business Media Relations

T +49 172 3603071

matthias.karpstein@traton.com

TRATON SE

Hanauer Str. 26 / 80992 Munich / Germany

www.traton.com

With its brands Scania, MAN, Navistar, and Volkswagen Truck & Bus, TRATON SE is the parent and holding company of the TRATON GROUP and one of the world’s leading commercial vehicle manufacturers. The Group’s product portfolio comprises trucks, buses, and light-duty commercial vehicles. “Transforming Transportation Together. For a sustainable world.” — this intention underlines the Company’s ambition to have a lasting and sustainable impact on the commercial vehicle business and on the Group’s commercial growth.