Developments of the autonomous truck

The commercial vehicle industry has faced particular challenges in the last couple of years, challenges that have the potential to disrupt the existing business model. These include, for example, climate change and the need to lower emissions, but also supply bottlenecks, political conflict, and the ever-increasing shortage of drivers worldwide. Especially when it comes to the driver shortage, autonomous vehicles may redistribute roles and give rise to new business models: in the future, autonomous trucks could provide a tremendous opportunity for all players along the transportation and logistics value chain. Consulting firm Berylls is confident: action is needed if we want to benefit from this transformation. Truck providers have to define their market launch strategies and prepare to commercialize their business model and the technological advances.

Since 2020, Berylls has published several studies on autonomous trucks and carried out a survey amongst 50 truck experts. The aim of this survey was to get a clear picture of where we stand at present. The survey participants included the MAN and Scania brands, as well as the TRATON GROUP itself. In addition to autonomous driving, it also focused on trends like digitalization, connectivity, and electrification. So what makes this industry tick? Steffen Stumpp, Head of Commercial Vehicles at Berylls Strategy Advisors, and Matthias Kempf, Partner at Berylls Digital Ventures, are the best people to ask.

TRATON: Your studies have already shown that autonomous vehicles have evolved continuously in the last few years. It won’t be long before they are operating under real-life conditions. To give you an example, an intelligent MAN truck is already making container transshipment from rail to road possible on a daily basis at a Deutsche Bahn container depot. MAN’s automation project Anita showed how the sensors in the driver cab can identify obstacles and manage to navigate reflections on wet asphalt, which can be treacherous. Which current trends are particularly worth talking about?

Steffen Stumpp (Berylls): What we are seeing is that autonomous trucks have the most potential when their business model focuses on hub-to-hub transportation: it is technically manageable, the environment is relatively straightforward with no pedestrians or traffic lights to watch out for, and it is profitable. In our study, we asked the experts if they could imagine these vehicles being used for regional and urban distribution in the long run. Their responses suggest that the more complex the traffic conditions and the more extensive the role of the driver, the more difficult it becomes to put this business model into practice. The question of usability, however, is less about technology and more about the economy. I do believe that fully automated vehicles will become technically possible somewhere down the line — although way past 2030. But there will come a point where the marginal costs will outweigh the benefits. The sweet spot is somewhere between the two, but it’s hard to know where right now — only time will tell. One thing is certain, however: these vehicles will first be deployed in hub-to-hub logistics. We expect this to become reality in the US initially, specifically in the sunshine states that have better weather and more favorable road conditions. The providers of autonomous technology already have specific plans in place to gradually roll it out across the whole of the US — from the Southwest to the Northeast. At the same time, they are working on specific plans for Europe while also planning their entry into the Chinese market.

TRATON: While there are specific plans to implement certain projects in the US, there is still a lack of uniform legislation. Europe is one step ahead in this respect. To what extent are these developments affecting autonomous driving in the different markets?

Steffen Stumpp (Berylls): Each US state has its own legislation, so at the moment providers are choosing the states with the most favorable overall conditions. However, this approach is unrealistic because trucks don’t just stop when they reach a state border. Having said that, I don’t expect policymakers to put a spanner in the works once autonomous driving technology has reached maturity and is on the cusp of a commercial breakthrough. I assume that lawmakers in Europe and the US alike will secure the overall framework needed for autonomous trucks to operate on the roads and do so in due time. Germany is leading the way with the latest amendment to its Road Safety Act, which came into force in July 2021.

Matthias Kempf (Berylls): I want to add that there is no Europe-wide approval procedure yet for autonomous driving at Level 3, which is also known as conditional driving automation, and higher. Instead, there are country-specific regulations. Approval is very complex: not only does the vehicle itself need to be approved along with its automated driving (AD) system, so does its operational design domain, or ODD. Federalism makes these procedures complicated. Yet you do get a general sense that policymakers are willing to implement this technology. After all, it’s not just about where it is deployed, it is also about our economic prosperity. Many cities and communities are already no longer able to afford regular and comprehensive public transportation services due to the shortage of drivers or budget cuts. Since the mobility system is key to a region’s economic power, policymakers have a vested interest in eliminating the regulatory hurdles standing in the way of autonomous vehicles coming to market as far as possible. The safety aspect requirements are, of course, warranted.

Perceptions of the autonomous truck in society

TRATON: It’s not just the policymakers we have to win over: society as a whole tends to give new technologies a hard time at the beginning. How can we improve the way the public sees autonomous trucks, especially compared to autonomous passenger cars?

Steffen Stumpp (Berylls): As human beings, we tend to be slightly biased there. Whenever an autonomous vehicle is involved in an accident, we start to question whether this technology should even be allowed in the first place. But we don’t challenge the entire status quo if the accident is caused by a driver. We ask a lot of this technology and are fairly intolerant of any mistakes and potential damage. This is also why it will take a few years still for autonomous truck development to reach series production. The technology already works under regular conditions, but a lot of cases are borderline, a lot of situations are exceptional. This is something that developers still have to eliminate. It means that these vehicles have many more miles and kilometers to cover, be it virtually or in real life, to make sure that these scenarios do not occur in practice. In case of doubt, technology will always choose the safer option. We should be prepared to see the occasional driverless truck parked up on the side of the road so as to avoid causing any more damage. We need to gradually test these boundaries as we move forward.

Matthias Kempf (Berylls): There are so many interesting insights to be found in research done alongside older pilot projects. With the exception of a few tech enthusiasts, people tend to be skeptical at the beginning of an AD initiative. The longer the service is in operation, the more people become curious and start to use it. If no notable incidents occur, customers more or less accept the technology after six months to a year at most — a classic diffusion model in action. If the service is intuitive and user-friendly, I am not overly concerned about customer acceptance, nor do I believe it will pose an obstacle to AD services prevailing across the board in the medium term.

Commercial opportunities for the autonomous driving business model

TRATON: What can the truck industry learn from its passenger car counterpart in this respect?

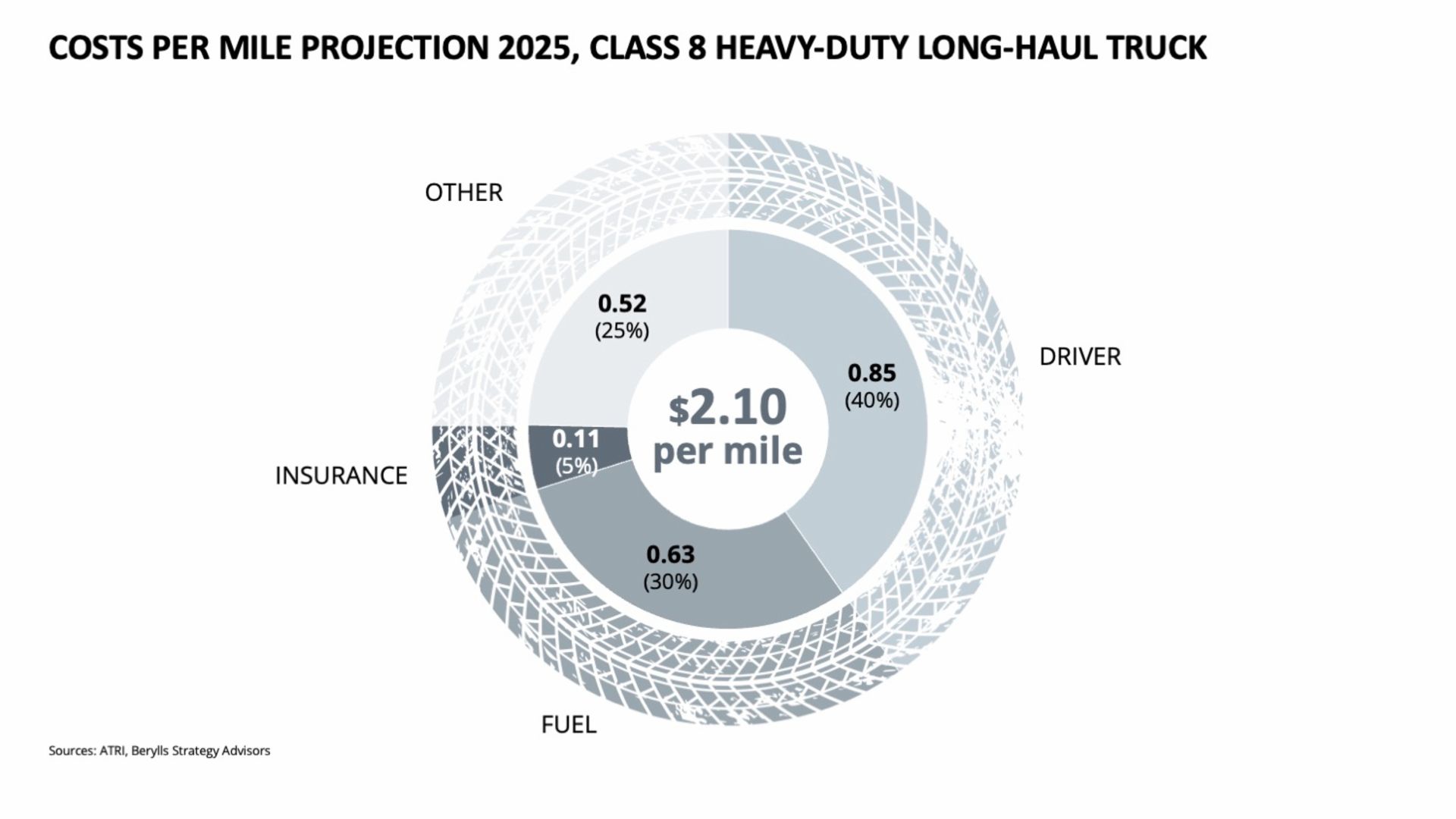

Steffen Stumpp (Berylls): Developers originally focused on passenger cars. Since then, the tide has turned. Now experts are saying that the potential of autonomous trucks is bigger, commercially speaking: firstly, these types of vehicles simply cover larger distances. Compared to passenger cars, they generate more revenue with each mile they drive, but also entail higher costs, which means more savings potential. Our study projects the following savings for these vehicles: while a regular Class 8 heavy-duty truck costs $2.10 per mile, an autonomous one is $0.95 or 45% cheaper.

So I believe that the truck segment is where autonomous driving will really come into its own, generating the most value both for the companies operating the vehicles and the economy as a whole. The passenger car and truck industries can learn from each other when it comes to overcoming the challenges. The technologies are fundamentally comparable, they are just employed on a different scale.

TRATON: Among other things, your study also looks ahead to future market launch strategies: what does it all come down to, what should brands and the TRATON holding specialize in?

Steffen Stumpp (Berylls): Technical implementation is an interesting topic, but so is looking at business models. I wanted to provoke in our study, so I asked the question of who will be supplying whom in the future. Tech players and truck manufacturers need to have a think about their business models. They need to clarify how they want to be seen by their customers and how they can fill the customer interface in the future. Who will bring out the vehicle, who will deliver it, and who will manage the interface to the customer? These are all exciting questions that commercial vehicle holdings needs to find the answers to.

-

Dr. Matthias Kempf (1974) was one of the founding partners of Berylls Strategy Advisors in August 2011. He began his career with Mercer Management Consulting in Munich, Germany, in 2000. After earning his doctorate degree and further consulting work at Oliver Wyman (formerly Mercer Management Consulting), he joined the management of Hilti Germany in 2008. At Berylls, his area of expertise is new mobility services and traffic concepts. In addition, he is an expert in developing and implementing new digital business models, and in the digitalization of sales and after sales. Industrial engineering and management studies at the University of Karlsruhe, Germany, doctorate degree at Ludwig Maximilian University, Munich, Germany.

-

Steffen Stumpp (1970) joined the Berylls Group in October 2020 as Head of Business Unit Commercial Vehicles. At this point, he already looked back on extensive professional and leadership experience in the commercial vehicle industry. Stumpp started his career in an OEM and went through different roles in research, marketing, product planning and after-sales service. When he switched to the automotive supplier industry, he took over the responsibility for worldwide sales and marketing of a medium-sized tier 1 supplier. After another step as head of sales he decided to join Berylls, where he is now responsible for the commercial vehicle business. Stumpp is a graduate engineer and has studied industrial engineering at the KIT in Karlsruhe and the Technical University of Berlin with focus on logistics.