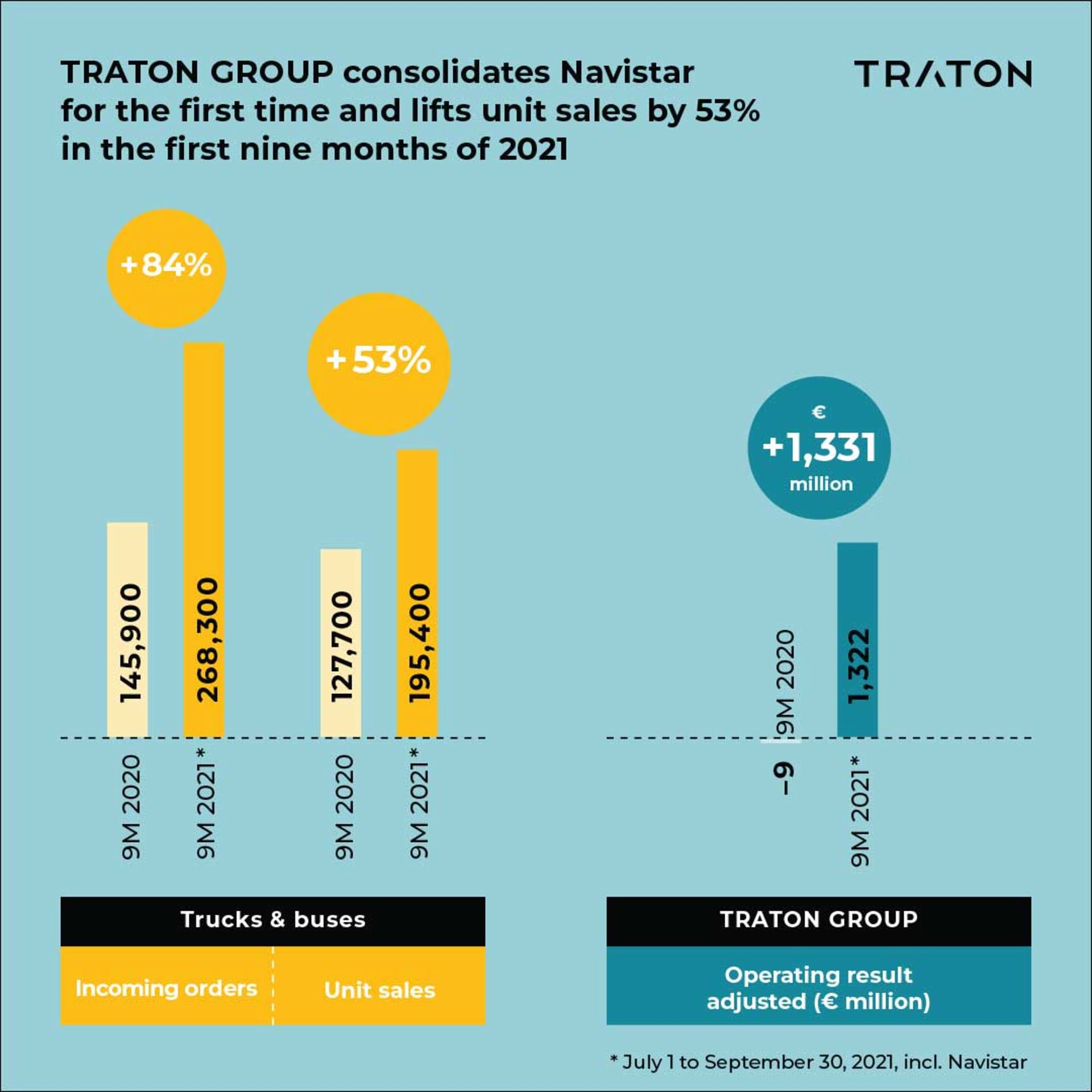

Munich, October 28, 2021 — The TRATON GROUP sold 53% more trucks and buses in the first nine months of 2021 in spite of ongoing shortages in the supply of semiconductors and other components. Total unit sales rose to 195,400 (9M 2020: 127,700) vehicles. Truck sales (including the MAN TGE van) grew by 58% to 182,800 (9M 2020: 115,800) units, while sales of buses increased by 6% to 12,600 (9M 2020: 11,800) units, impacted by the continuing travel restrictions. The TRATON GROUP consolidates Navistar for the first time in its 9M 2021 Interim Statement as of September 30, 2021. As a result, the prior-period figures are only comparable to a limited extend.

Christian Levin, CEO of the TRATON GROUP: “Managing the supply chains remains a big challenge, but we find new solutions every day to serve our customers as quickly as possible. Our entire industry is experiencing a perfect storm right now. Having said that, I am very optimistic that the TRATON GROUP will emerge all the stronger from this storm and then be able to sharpen its competitive edge.”

Including Navistar, incoming orders rose by 84% to 268,300 vehicles. Similarly, incoming orders for trucks, which climbed by 89% to 255,000 (9M 2020: 134,600) vehicles, were significantly higher than for buses, which grew by 18% to 13,300 (9M 2020: 11,300). Sales revenue for the first nine months of 2021 amounted to €21.7 billion (9M 2020: 15.7 billion), an increase of 38%.

Adjusted operating result amounted to €1,322 million, a marked increase compared with €–9 million in the first nine months of 2020. The adjusted operating return on sales reached 6.1%, up from –0.1% in the same period of the previous year. Operating result came to €641 million (9M 2020: –58 million) and operating return on sales to 3.0 (9M 2020: –0.4)%. The book-to-bill ratio, expressed as incoming orders over unit sales, was 1.37 (9M 2020: 1.14).

Overview of the TRATON GROUP

Sales revenue in the Industrial Business segment rose by 38% to €21.3 billion (9M 2020: 15.4 billion), due primarily to the very sharp increase in the truck and van business. Sales revenue from the After Sales business also climbed sharply. Adjusted operating result in the Industrial Business came to €1,157 million (9M 2020: –91 million). Operating result in the Industrial Business amounted to €476 million (9M 2020: –140 million). This segment’s operating return on sales was 2.2% (9M 2020: –0.9%).

The Financial Services segment generated sales revenue of €683 million (9M 2020: 612 million). Operating result almost doubled to €170 million (9M 2020: €82 million).

The operating units at a glance

Scania Vehicles & Services saw its unit sales increase by 41% to 67,200 (9M 2020: 47,700) vehicles. Sales revenue was up 27%, rising to €10.3 billion (9M 2020: 8.1 billion). Operating result came to €1,099 million (9M 2020: 419 million). Operating return on sales was 10.7% (9M 2020: 5.2%). No adjustments to operating result have been made during the first nine months.

MAN Truck & Bus recorded unit sales of 68,600 (9M 2020: 53,500) vehicles, an increase of 28%. Sales revenue grew by 22%, rising to €8.0 billion (9M 2020: 6.6 billion). Adjusted operating result came to €245 million (9M 2020: –414 million), corresponding to an adjusted operating return on sales of 3.1% (9M 2020: –6.3%). The repositioning of MAN Truck & Bus gave rise to expenses of €681 million.

Volkswagen Caminhões e Ônibus saw its unit sales climb by 70% to 45,600 (9M 2020: 26,800) vehicles. Sales revenue was up by three quarters, increasing to €1,623 million (9M 2020: 931 million). Operating result came to €132 million (9M 2020: –6 million).

Operating return on sales rose to 8.1% (9M 2020: –0.6%). No adjustments to operating result have been made during the first nine months.

The new operating unit Navistar Manufacturing Operations recorded incoming orders of 23,600 vehicles in the first quarter of its consolidation. Unit sales from July until the end of September stood at 14,100 vehicles, broken down into 11,300 trucks and 2,800 buses. Sales revenue reached €1.7 billion for the three months. Operating result came to €42 million and operating return on sales was 2.5%. Operating result was negatively impacted by transaction costs for the Navistar acquisition in the amount of €40 million. For financial information on the initial consolidation of Navistar refer to page 42ff. of the 9M 2021 Interim Statement.

Forecast for the TRATON GROUP

The TRATON GROUP has issued its first guidance for fiscal year 2021 that includes Navistar in its 9M 2021 Interim Statement for the period ended September 30, 2021.

Subject to further developments in strained supply chains in the fourth quarter and the resulting potential production stoppages, or potential new restrictions stemming from the COVID-19 pandemic, the Executive Board of TRATON SE anticipates a very sharp year-on-year increase in unit sales for the TRATON GROUP in full-year 2021. A very sharp increase in sales revenue is also expected. These forecasts take into account Navistar’s unit sales and sales revenue in the second half of 2021.

Contingent on the market and revenue assumptions described here and based on the first three quarters, the Executive Board of TRATON SE forecasts an operating return on sales in the range of 5.0 to 6.0% for the TRATON GROUP for 2021 as a whole.

The forecast does not include any expenses for restructuring measures for the repositioning of MAN Truck & Bus. Earnings effects from the purchase price allocation relating to the acquisition of Navistar are not included in the forecast, either.

TRATON SE’s Executive Board expects net cash flow in the Industrial Business segment to amount to between €0 million and €300 million for fiscal year 2021 due to the current supply shortages and the resulting impact on working capital. This estimate does not include the purchase price for the Navistar acquisition amounting to €2,584 million (purchase price after deduction of cash and cash equivalents at Navistar Manufacturing Operations at the time of acquisition). The forecast also does not include any expenses for restructuring measures for the repositioning of MAN Truck & Bus.

The forecast generally reflects a high degree of uncertainty about the further impact of supply shortages on production and unit sales as well as on our financial KPIs for the rest of the year. The Group’s working capital as of the end of the year will be influenced to a major extent by the production volume that can be realized in the last few weeks of the year and is therefore subject to particular uncertainty.

Contact:

Sacha Klingner

Head of Corporate Communications

T +49 170 225 0016

sacha.klingner@traton.com

Matthias Karpstein

Business Media Relations

T +49 172 3603071

matthias.karpstein@traton.com

TRATON SE

Dachauer Str. 641 / 80995 Munich / Germany

www.traton.com

With its Scania, MAN, Volkswagen Caminhões e Ônibus, Navistar, and RIO brands, TRATON SE is one of the world’s leading commercial vehicle manufacturers. Its range comprises light-duty commercial vehicles, trucks, and buses. The Group seeks to transform the transportation system — with its products, its services, and its partnership with its customers. For TRATON, sustainable economic growth always includes treating people and nature with respect. The People, Planet, and Performance triad will shape the future of our Company.